Debt to Income (DTI) Calculator -User Guide

Introduction

Hey there, fellow finance enthusiasts! Are you struggling to manage your debts? Do you find it hard to keep track of your income and expenses? Well, worry no more! In this user guide, we will take you through the ins and outs of using a Debt to Income (DTI) calculator to help you gain control of your financial situation. So, grab a cup of coffee, sit back, and let’s dive right in!

What is a Debt to Income (DTI) Calculator?

Before we delve into the details, let’s first understand what a DTI calculator is all about. Simply put, a DTI calculator is a tool that helps you assess your financial health by calculating your Debt to Income ratio. This ratio is a crucial indicator of your ability to manage your debts and make timely payments. By using a DTI calculator, you can get a clear picture of your financial standing and make informed decisions regarding loans, mortgages, and other financial commitments.

How Does It Work?

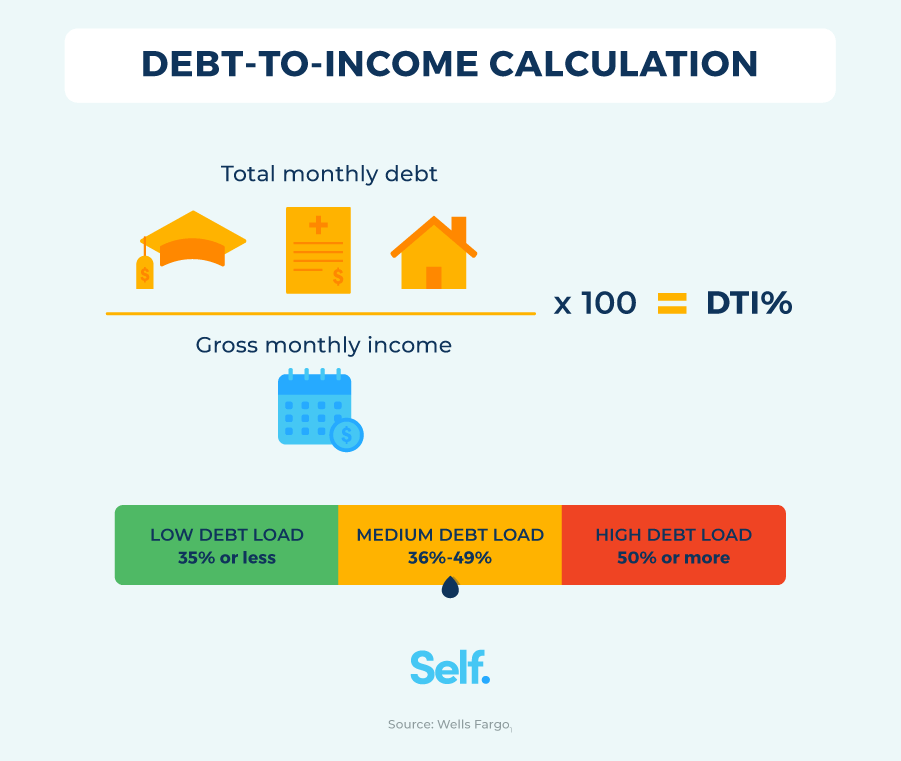

Using a DTI calculator is as easy as pie! All you need to do is input your monthly income and your monthly debt payments. The calculator will then crunch the numbers and give you your DTI ratio. This ratio is expressed as a percentage and represents the proportion of your income that goes toward paying off your debts. The lower the ratio, the better your financial health.

Why Use a Debt to Income DTI Calculator?

Now, you might be wondering why you should bother using a DTI calculator. Well, let us give you a few compelling reasons:

Gain Financial Awareness: By calculating your DTI ratio, you get a clear understanding of how much of your income is going towards debt repayment. This awareness helps you identify areas where you can cut back and save more.

Evaluate Loan Eligibility: When you apply for a loan or a mortgage, lenders often consider your DTI ratio as a key factor in determining your eligibility. By knowing your ratio in advance, you can assess your chances of getting approved for a loan and plan accordingly.

Make Informed Financial Decisions: Armed with the knowledge of your DTI ratio, you can make informed decisions about taking on new debts. You can evaluate whether you can comfortably afford the monthly payments based on your current income and existing debt obligations.

Tips for Using a DTI Calculator

To make the most out of your DTI calculator experience, here are some handy tips:

Be Honest and Accurate: When inputting your income and debt information, be sure to provide accurate figures. Remember, the calculator’s results are only as good as the data you input.

Update Regularly: As your financial situation changes, so does your DTI ratio. Make it a habit to update your income and debt figures regularly to get an accurate reflection of your current financial health.

Set Goals: Use the calculator to set realistic goals for improving your DTI ratio. Whether it’s paying off debts or increasing your income, having a target in mind can motivate you to take the necessary steps towards financial freedom.

Debt to Income (DTI) Formula

A formula is a mathematical expression or equation that represents a relationship between variables. It is a concise and systematic way of describing a mathematical concept or calculation.

Formulas are used in a wide range of fields, including physics, chemistry, engineering, finance, and more. They provide a framework for understanding and solving complex problems by expressing relationships and dependencies between different quantities.

A formula typically consists of variables, constants, and mathematical operators. Variables represent unknown quantities or values that can change, while constants are fixed values. Mathematical operators such as addition, subtraction, multiplication, and division are used to manipulate and combine these variables and constants to obtain the desired result.

Formulas can be simple or complex, depending on the specific problem or concept they are addressing. They can be derived from fundamental principles or laws in a particular field or developed through empirical observations and experimentation.

Understanding and applying formulas is essential for solving mathematical problems, analyzing data, and making predictions. They provide a universal language for communicating mathematical concepts and calculations, enabling scientists, engineers, and researchers to collaborate and share their findings.

It is important to note that formulas should be used with caution and within the appropriate context. They are powerful tools for problem-solving, but their validity and applicability depend on the assumptions and limitations of the underlying theory or model.

In summary, formulas play a crucial role in various disciplines, allowing us to express and manipulate mathematical relationships. They are indispensable tools for exploring the laws of nature, making scientific discoveries, and solving real-world problems.

Pros and Cons Debt to Income (DTI)

Pros

Provides a balanced view: Listing the pros and cons of a topic allows you to weigh the positive aspects and benefits associated with it.

Helps in decision-making: By understanding the pros of a specific option, you can make informed decisions and choose the best course of action.

Offers a comprehensive analysis: Evaluating the pros helps in gaining a deeper understanding of the subject matter by considering various perspectives and factors.

Identifies advantages: Highlighting the pros helps to identify the potential advantages and strengths of a particular option or situation.

Supports persuasive arguments: When presenting an argument, discussing the pros can strengthen your position and make your case more convincing.

Cons

Presents a balanced perspective: Discussing the cons ensures that you consider the potential drawbacks and limitations associated with a topic.

Enables risk assessment: By understanding the cons, you can assess the potential risks and challenges involved in a particular decision or action.

Facilitates critical thinking: Evaluating the cons encourages critical thinking by analyzing potential negative consequences and exploring alternative options.

Helps in problem-solving: Identifying the cons allows you to anticipate and address potential problems or obstacles that may arise.

Promotes well-rounded decision-making: Considering both pros and cons leads to more well-rounded and informed decision-making processes.

Frequently Asked Questions (FAQ)

Q: What is a FAQ?

A: FAQ stands for Frequently Asked Questions. It is a compilation of commonly asked questions about a particular topic along with their corresponding answers.

Q: Why are FAQs important?

A: FAQs are important because they provide quick and concise answers to commonly asked questions. They help save time by addressing common concerns and providing solutions without the need for extensive research or contacting customer support.

Q: Who benefits from FAQs?

A: FAQs benefit both the users or customers and the service providers or businesses. Users benefit by getting immediate answers to their questions, while businesses benefit by reducing customer support inquiries and improving overall customer satisfaction.

Q: How should FAQs be organized?

A: FAQs should be organized in a clear and logical manner. They can be grouped into categories or topics to make it easier for users to find the information they need. Each question should be followed by a brief and concise answer.

Q: How can I create effective FAQs?

A: To create effective FAQs, consider the most common questions and concerns that users may have. Use clear and simple language, and provide accurate and up-to-date answers. Regularly update and expand your FAQs based on user feedback and evolving needs.

Q: How can I make FAQs more user-friendly?

A: To make FAQs more user-friendly, consider adding a search function, using headings and subheadings, and formatting the content in an easy-to-read manner. You can also include links to related articles or resources for further information.

Q: Can I use FAQs for different purposes?

A: Yes, FAQs can be used in various contexts, such as websites, product documentation, customer support knowledge bases, and more. They are versatile and can be customized to fit the specific needs of different industries and businesses.

If you have any more questions that are not covered in this FAQ, feel free to reach out to our support team for further assistance.

Conclusion

Congratulations! You have now become well-versed in the world of DTI calculators. Armed with this knowledge, you can take control of your debts, make informed financial decisions, and pave the way toward a brighter financial future. Remember, managing your finances is not just about crunching numbers, it’s about gaining financial awareness and taking proactive steps towards a debt-free life. So, go ahead, give that DTI calculator a try, and start your journey towards financial freedom today!

Happy calculating!

Disclaimer: The information provided in this user guide is for educational purposes only and should not be considered as financial advice. Always consult with a professional financial advisor before making any financial decisions.